Market Context

Overview of Mexico’s tourism sector

- 1st Most Developed Hospitality Market in LatAm (Increasing international arrivals, new-build hotels and resorts, strong RevPAR and occupancy trends) 2.

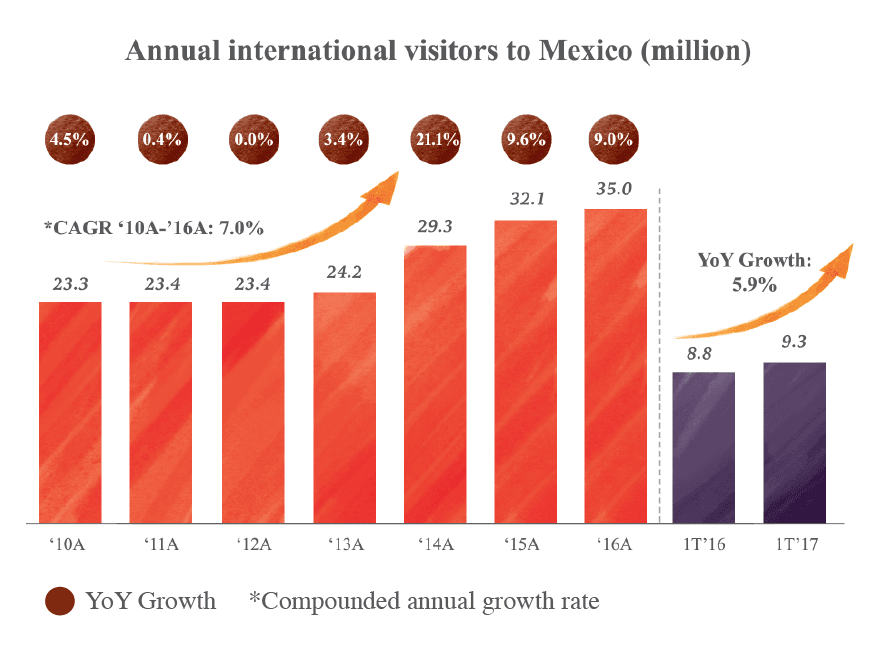

- 2nd Fastest Growing Country in Tourist Arrivals (9.6% YoY growth in 2015) 3.

- 6th Most World Heritage Sites (33 sites divided into 27 cultural, 5 natural and 1 mixed in 2015) 4.

- 8.4% of Mexico’s 2015 GDP (Ps. 1,155mm in 2015) 5.

- 9th Most Visited Country in the World (32.1mm international visitors in 2015) 6.

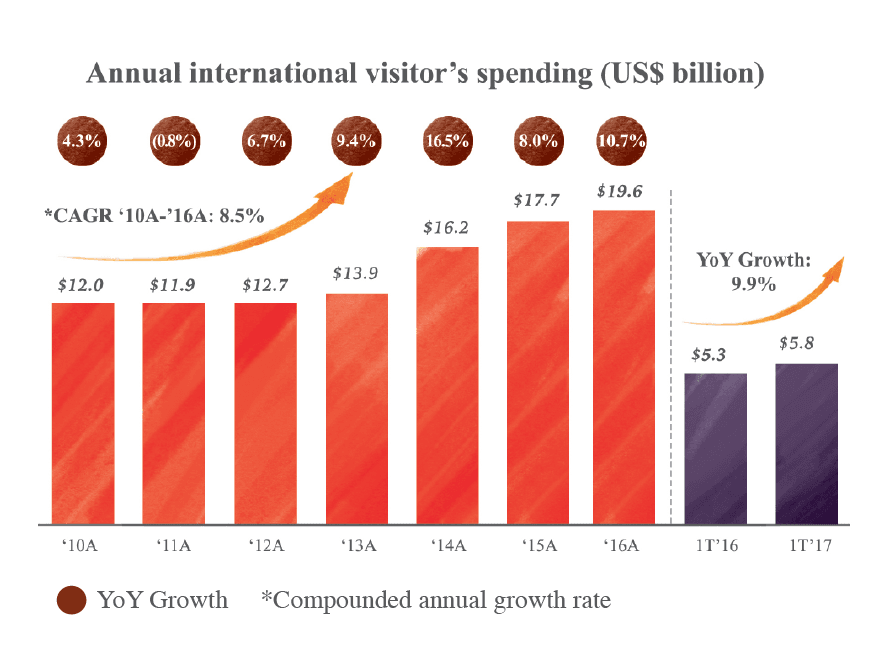

- 17th Largest Annual International Visitor Spending in the World (US$17.7bn in 2015) 7.

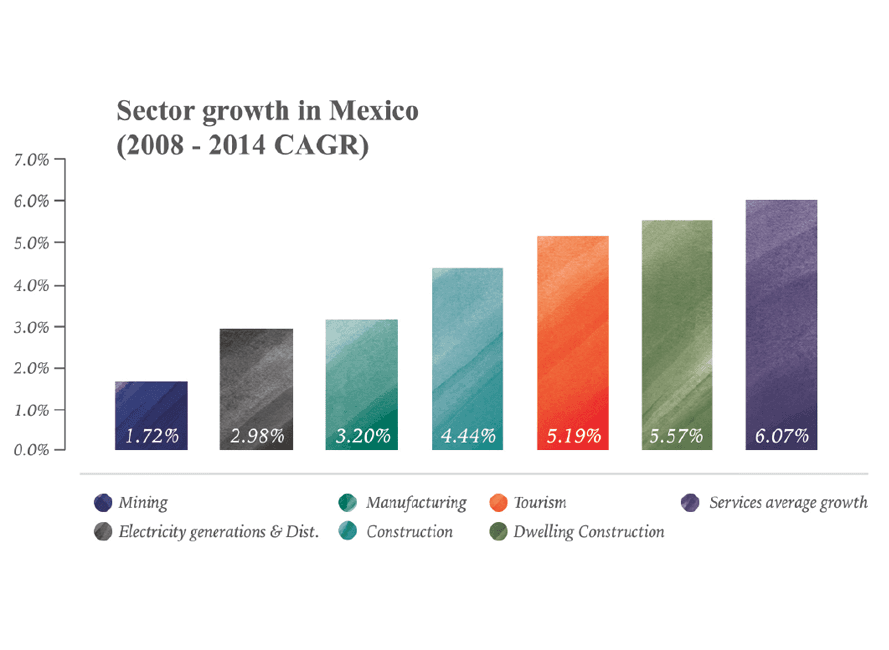

- Tourism is one of the fastest growing industries in Mexico due to:

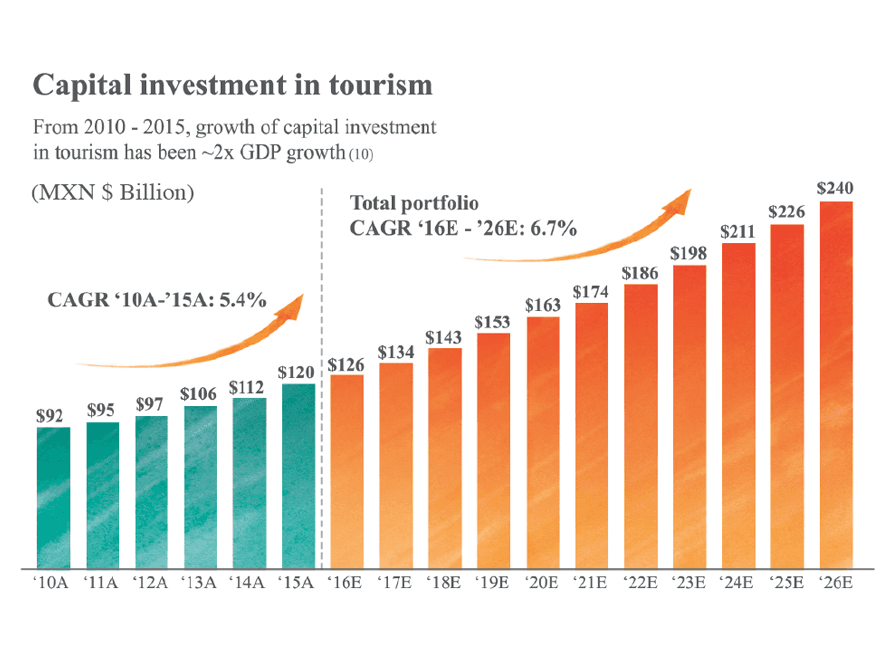

- Significant investment in tourism related infrastructure.

- U.S. Dollar appreciation against the Mexican Peso.

- Close proximity to countries with sustainably growing economies.

- Development in airline infrastructure, destinations and route connectivity.

- Improved international travel connectivity driven by a new international airport in Mexico City, opening in October 2020, with an initial investment of Ps. 169bn (~US$9.0bn) 8.

- The current airport recorded 38.4mm passenger arrivals in 2015.

- The new international airport is expected to receive 50mm passengers in its first phase, which represents a 30% increase over 2015 passenger arrivals; and 125mm passengers upon completion, which represents a 225% increase 9.

- New bilateral “Open Skies” agreement between the U.S. and Mexico will further increase air connectivity.

- New air routes allow for better connectivity with smaller cities in the U.S. and Canada and expected to drive increased air traffic to Mexico.

- Construction of a new terminal in Cabo San Lucas Airport (expected completion by the end of 2017) which will be able to handle 3 big airplanes.

2 Hotel & Hospitality Group, “Hotel Destinations Mexico” by JLL, February 2016

3 Datatur

4 UNESCO, Heritage Cultural Sites

5 INEGI, annual GDP at constant 2008 prices

6 Datatur

7 Datatur

8 Forbes, “10 Puntos clave sobre el nuevo aeropuerto”

9 New Mexico City International Airport website

10 World Travel & Tourism Council, “Travel & Tourism Economic Impact 2016 Mexico”, INEGI

Los Cabos influx of tourists

- The unique landscape and culture of Mexico’s beach destinations attract a consistently growing influx of tourists from all over the world.

- Visitor traffic originates primarily from the U.S., Canada and within Mexico, with access to an international market of ~359 million people (U.S. & Canada) with average flight range of 3 hours (max. six hours) 11.

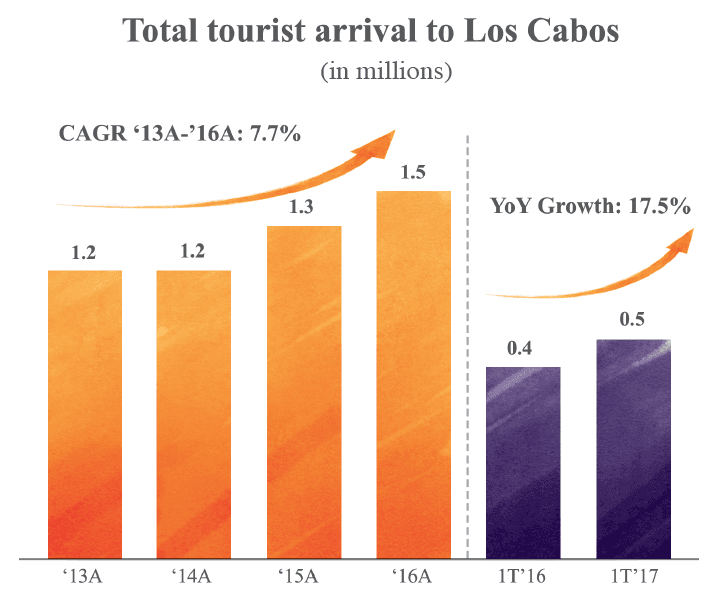

- Tourist arrivals to Los Cabos International Airport have grown at a 7.7% CAGR from 2013 - 2016 and 17.5% from the first quarter of 2016 to the first quarter of 2017 12.

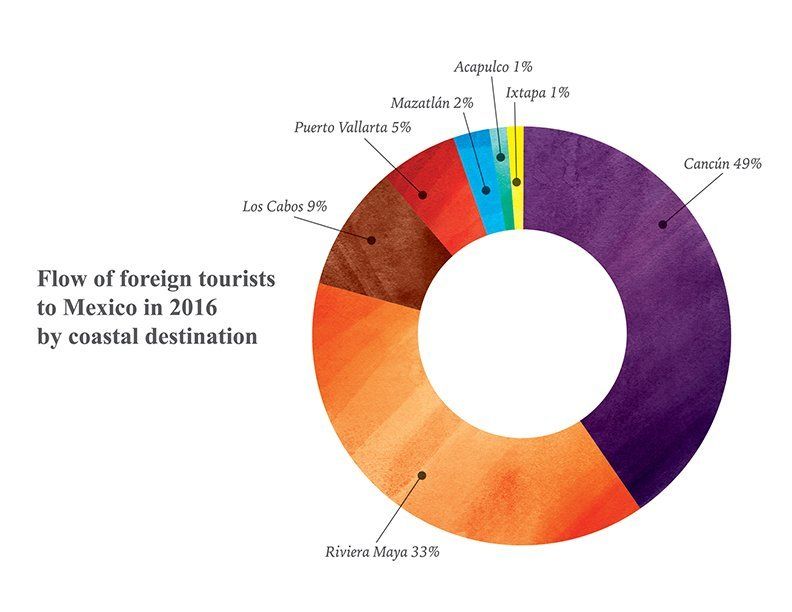

- Los Cabos captured 14% of total tourist arrivals in Mexico’s coastal destinations in 2016, growing at a 5.9% CAGR from 2010-2016 13.

11 Travelmath

12 Sectur

13 Sectur

The lodging market in Los Cabos

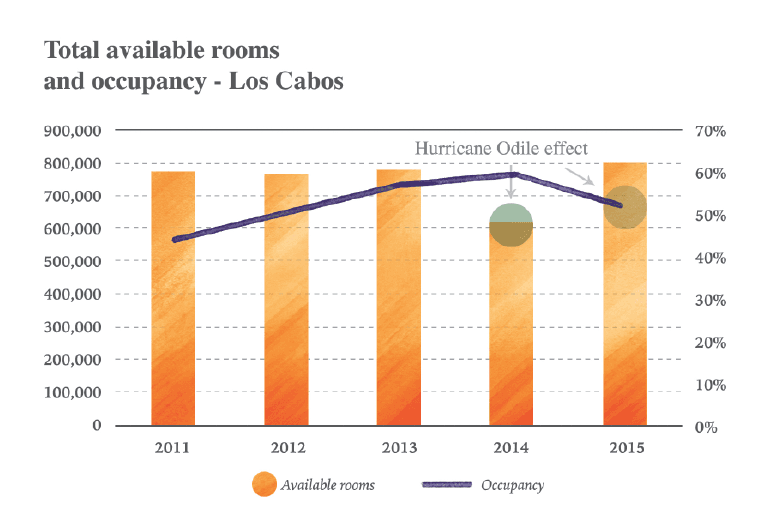

- The hotel supply and occupancy in Los Cabos has steadily grown in past years, excluding 2015 when Hurricane Odile hit Los Cabos in September 2014 13.

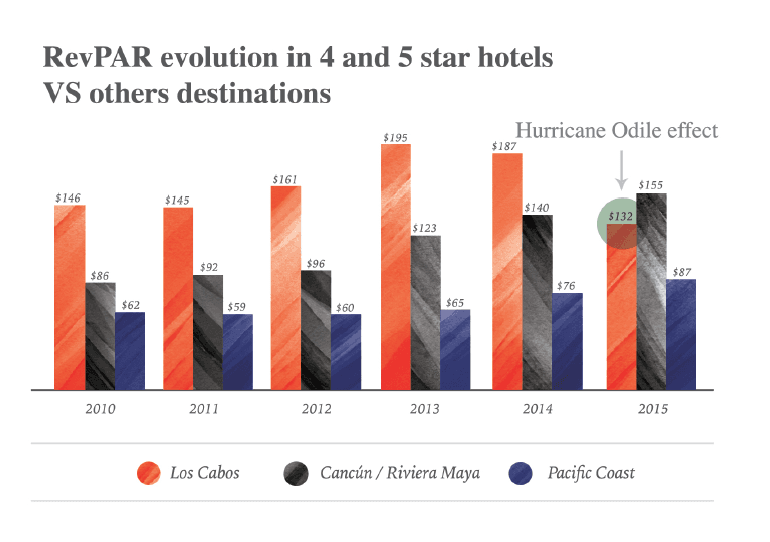

- The RevPAR in 4 and 5 star hotels in Los Cabos has outperformed other destinations in past years 14.

- Currently there are 2,390 new rooms planned or under development in Los Cabos for the next 4 years 15.

Vacation Home Market

United States vacation home market

- The near-term outlook for the United States economy remains positive in the face of greater global uncertainties.

- The United States vacation home market has recovered strongly since the 2008/2009 economic recession.

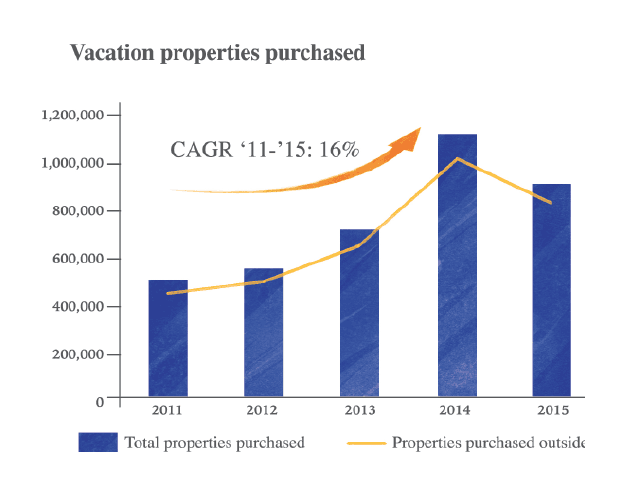

- The number of vacation properties purchased by United States households increased at a 16% CAGR between 2011-2015, increasing in the same proportion the vacation properties purchased outside the United States 16.

- The US$10mm+ net worth population increased 118% between 2010-2015, to 870 thousand persons 17.

- Among the wealthiest top 1% of United States households, defined as having annual income of US$400k and/or net worth of US$8mm+, Mexico appears as the preferred foreign destination 18.

- Lifestyle factors remain the primary motivation for United States vacation-home buyers, with 40% of them having purchased a property in a beach area in 2015 19.

13 Sectur

14 Market insight from several specialized sources

15 Market insight from several specialized sources

16 NAR Investment and Vacation Home Buyers Survey

17 Global Luxury Real Estate Report October 2016

Luxury Portfolio International

18 Resonance Consultancy – Future of Luxury Travel 2016 Report

19 National Association of Realtors – Vacation Home Sales Retreat 2016

Vacation home market in Los Cabos

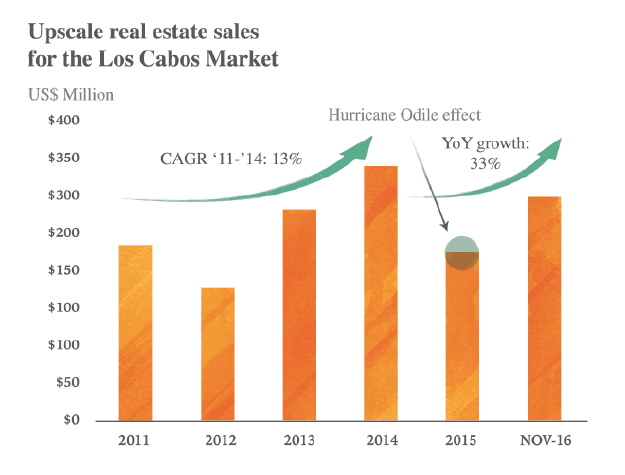

- The market is recovering from Hurricane Odile and in the first eight months of 2016 surpassed the performance of the same period in 2015.

- Total sales volume is up by 50% to $156mm 20.

- Total numbers under contract are up by 15% to 290 contracts 21.

- The average sales price is up by 44% to US$618k 22.

- The upscale real estate sales for the Los Cabos market increased at a 13% CAGR between 2012-2014 and 33% between 2015 and November 2016, adding confidence to pricing trends which increased 44% between 2015 and November 2016 23.

- Expectations for 2017-2020 are very bullish considering that the active marketing of new upscale communities has just begun (i.e. Chileno Bay, Maravilla, Solaz) 24.

- Since the available oceanfront land in the Los Cabos Corridor is decreasing due to these dynamic development trends, the East Cape is anticipated to be the next area to gain strong attention for development.

20 El Anhelo – Market study and Opportunities Feb 2017 (Boutique Real Estate Advisors)

21 El Anhelo – Market study and Opportunities Feb 2017 (Boutique Real Estate Advisors)

22 El Anhelo – Market study and Opportunities Feb 2017 (Boutique Real Estate Advisors)

23 American Affluence Research Center – Fall 2014 report

24 MLS Data, El Anhelo – Market study and Opportunities Feb 2017 (Boutique Real Estate Advisors)

Timeshare Market in Los Cabos

Boutique Real Estate Advisors, a real estate advising firm with expertise in the hospitality, timeshare and resort development industries, recently conducted a study of the timeshare markets for a proposed development project in the Los Cabos Corridor.

According to Boutique Real Estate Advisors, after a thorough review of the timeshare, condominium and hotel markets in Los Cabos (including discussions with key operating personnel and real estate experts in the market), it is clear that timeshare stands out as the best development opportunity for maximizing the value of real estate.

The timeshare industry is thriving year over year as indicated by reports provided by industry leaders such as ARDA. The most recent report for 2017 indicates sales volume increases for the se-venth straight year — by nearly 7% from $8.6 billion in 2015 to $9.2 billion in 2016. Rental revenue also increased, rising 5% from $1.8 billion in 2015 to $1.9 billion in 2016, as the average daily rental price increased from $172 to $189.

Operating performance metrics for the industry were also encou- raging in 2016. Average occupancy was nearly 79% — by comparison, hotel occupancy was 65.5% in 2016, according to Smith Travel Research. The weighted average maintenance fee charged per weekly interval was $970, up by approximately 5% from $920 per interval in 2015.

By considering these metrics and the value it adds to resorts,

developers can monetize real estate offerings of large resort developments successfully for the greatest economic return.